Get the cost of a card payment transaction on demand, generate payment cost forecast and optimize payment cost and profitability with AI, this is the aim of our scheme cost and interchange monitoring solution.

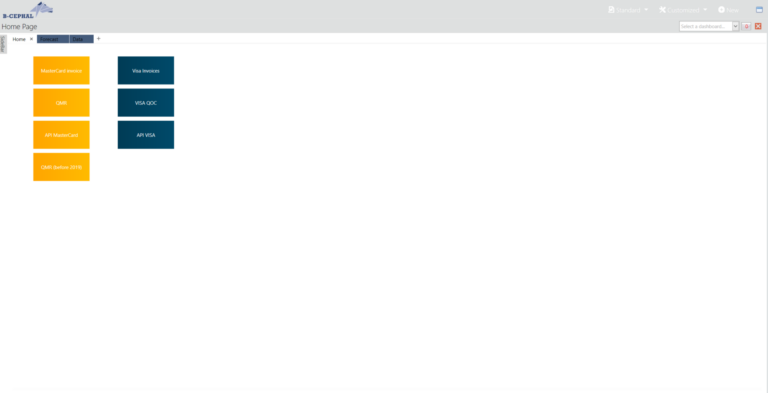

Dedicated to issuers, acquirers and large merchants, our solution offers:

- Regular and systematic scheme invoice monitoring

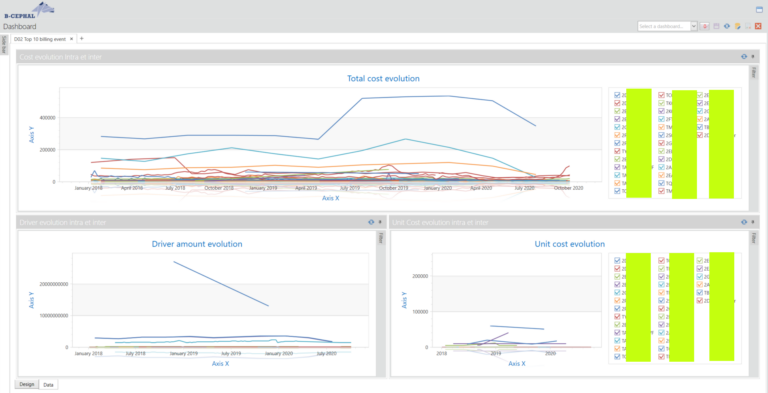

- Cost, unit cost and cost driver monitoring per billing event

- New billing event review

- Abnormal cost trend automatic identification

- Cost amount consistency control per billing event

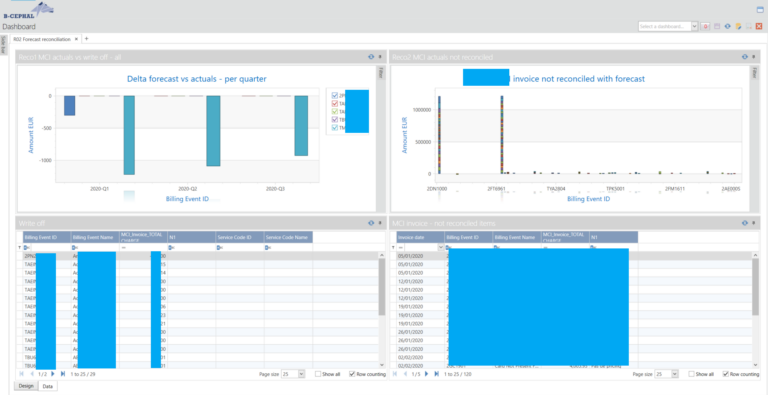

- Reconciliation scheme invoice with settlement

- Automatic reconciliation between financial movements and scheme invoices

- Scheme cost forecast

- Forecast for regular budget exercises

- Forecast for scenario & strategic options analysis

- Forecast for card portfolio rationalization

- Scheme fee calculation per transaction

- Calculate scheme cost per transaction

- Optimize pricing and net payout calculation (for acquirers)

- Interchange (POS and ATM) analytics

- Benchmark

- Alarms & analytics

The scheme invoice analytics reduces the time in back office to compile scheme costs data and offers a regular, robust and reliable analytics solution to pilot card business for issuing and acquiring institutions.